Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference

– The banking and microfinance sector

Within the WAEMU, Togo has a dynamic financial sector with specific characteristics: a multiplicity of actors, versatility in activities, a very pronounced aversion to risk and very active competition between actors.

Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference

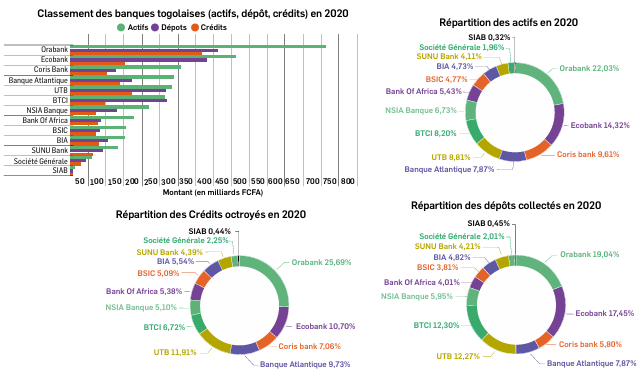

Togo has 14 banks, including 11 subsidiaries and 3 branches, and 3 banking-related financial institutions, including 2 subsidiaries (Source: BCEAO). These figures demonstrate the vitality of the banking sector, which saw the opening of 78,597 additional accounts in 2020. In 2021, the number of citizens holding bank accounts in credit institutions (banks, postal services, national savings banks) was 1,178,587, compared to 1,099,990 in 2019. With 4.98 bank branches per 100,000 inhabitants, Togo has one of the highest ratios in WAEMU. Banks are playing a more significant role in economic growth and private sector development.

Orabank Togo has been named the best bank in Togo in 2021 by the financial magazine Global Finance, in its ranking covering more than 160 countries and regions. In Togo, the Oragroup subsidiary thus takes the top spot in this 28th annual list of the world's best banks, dethroning the other giant in the Togolese banking sector, Ecobank, which was the winner in 2020.

Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference

In the difficult economic context caused by the health crisis, Togolese banks have generally appeared resilient since 2020. Despite the surge in the cost of risk that hampered net results, assets held up thanks to strong deposit performance. Covid-19 has forced an accelerated race towards digitalization, and 12 banks in Togo are offering digital financial services to their customers. This digitalization includes information, support, and advisory services for managing various transactions. Two banking institutions have added "Mobile Banking via WhatsApp" solutions to their offerings, allowing their customers to carry out transactions at any time of the day, every day of the week, from their bank accounts. These efforts, which are in line with one of the Government's priorities—the digitalization of the public sector—and the ambition to establish a digital bank to better strengthen financial inclusion. The aim is to set up a digital 100% banking structure to support the economy and enable coverage of the entire Togolese territory in order to bridge digital divides despite progress in terms of financial inclusion.

Slowed in 2020 due to the Covid-19 health crisis, the activities of microfinance structures have resumed in force, as shown by the latest statistics published by the BCEAO. This dynamic reflects a general trend across all areas in all WAEMU member countries: deposit collection, loan granting, and account opening. In Togo, microfinance institutions are participating in improving financial inclusion, particularly in providing access to financing systems for rural and peripheral populations. The major role of the state-owned structure, the National Fund for Financial Inclusion (FNFI), has enabled Togo to move from a financial inclusion rate of 72.5% in 2016 to 81.5% in 2020, thus occupying second place within WAEMU. The overall geographic penetration rate of financial services in Togo increased from 81 points in 2016 to 422 points in 2020, while the overall demographic penetration rate of financial services stood at 50 points in 2020 compared to 11 points in 2016.

Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference